What is Form 2290 and why do you need it?

There are so many rules and regulations when it comes to Trucking. In the beginning it is di fficult to navigate and more than likely you will forget a step. The Heavy Highway Vehicle Use Tax is one that most people forget to tell you about until you're applying for your cabcard. And now you're wondering what it is and why you need it?

fficult to navigate and more than likely you will forget a step. The Heavy Highway Vehicle Use Tax is one that most people forget to tell you about until you're applying for your cabcard. And now you're wondering what it is and why you need it?

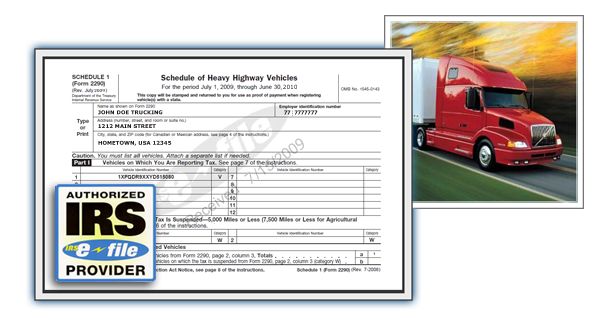

The Heavy Highway Vehicle Use Tax has many different names and gets confusing. The majority refer to it as Form 2290 as this is the IRS form in which you file this tax. Other names include Heavy Vehicle Used Tax or HVUT, Truck Tax and Highway Vehicle Tax. However, I prefer to call it 2290.

Now that we know it's not five different taxes but one with many names... Who needs to file this form? Well, If you own and operate a Heavy Vehicle and it has a gross weight over 55,000 pounds or more, then you are responsible for filing Form 2290. This applies to Truckers, Owner Operators and any individual that operates on public highways.

When to file is another hot topic especially when you purchase a new or used Heavy Vehicle. Generally, you have until August 31st to file Form 2290 if you've had the vehicle throughout the year. If you just purchased the vehicle, technically you have 60 days to file Form 2290. When registering the vehicle you can present your sales receipt to the state instead of the 2290. But the law requires you to file Form 2290 by the last day of the month following the month of first use.

Some people use a Carrier Servicing Company to file their Form 2290 but the fees can range from $75 to $100 per vehicle on top of the Tax paid to the IRS. I prefer to use eForm 2290 as they are very easy to use and will save you money and get your Schedule 1 within Minutes. If you don't want to pay anything you can go the Manual route and file Form 2290 via Mail. But it could take weeks to get there and weeks to get a copy of your schedule 1. Here is the IRS Form 2290 all you have to do is print it out and mail it along with your check.

Now that you know what the 2290 is and why you need it, it's best to set an Annual Calendar Reminder that way you do not pay any penalties for not filing on time.

21 Jun 2022